UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule §240.14a-12

| | |

| NV5 GLOBAL, INC. |

| (Name of Registrant as Specified In Its Charter) |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

NV5 Global, Inc.

200 South Park Road, Suite 350

Hollywood, Florida 33021

Telephone: (954) 495-2112

April 23, 2021May 1, 2023

Dear Stockholder:

You are cordially invited to attend this year’s annual meeting of stockholders of NV5 Global, Inc., a Delaware corporation, on Saturday,Tuesday, June 5, 202113, 2023 at 9:2:00 a.m.p.m., PacificEastern Time, which will be a virtualhybrid meeting, conducted both in person and via live webcast. This means that you may attend the Annual Meeting either in person at the NV5 Global, Inc. office at 200 South Park Road, Suite 350, Hollywood, Florida 33021, or virtually via a live audio webcast by clicking meetnow.global/ MWNDH7U at the time and date noted above.

The virtualhybrid meeting format allows all of our stockholders the opportunity to participate in the annual meeting no matter where they are located. If you plan to attend the annual meeting virtually on the Internet, please follow the instructions in the "Questions and Answers About the Proxy Materials and the 20212023 Annual Meeting" section of this proxy statement.

We are pleased to take advantage of the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials primarily over the Internet. We believe that it will expedite stockholders’ receipt of proxy materials, lower costs and reduce the environmental impact of distributing proxy materials for our annual meeting. As of April 23, 2021,May 1, 2023, we have commenced mailing to our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials, including our 20212023 Proxy Statement and Annual Report to Stockholders for the fiscal year ended January 2, 2021December 31, 2022 (the “2020“2022 Annual Report”), over the Internet. The Notice also includes instructions on how you can receive a paper copy of the proxy materials by mail. If you receive your annual meeting materials by mail, the Notice, 20212023 Proxy Statement, 20202022 Annual Report and proxy card will be enclosed. If you receive your proxy materials via e-mail, the e-mail will contain voting instructions and links to the 20202022 Annual Report and 20212023 Proxy Statement on the Internet, both of which are available at http://www.edocumentview.com/NVEE.

The matters to be acted upon are described in the Notice and 20212023 Proxy Statement. Following the formal business of the meeting, we will report on our operations and respond to questions from stockholders.

Whether or not you plan to participate in this year’s annual meeting, your vote is very important and we encourage you to vote promptly. After reading the 20212023 Proxy Statement, please promptly mark, sign and date the enclosed proxy card and return it by following the instructions on the proxy card or voting instruction card or vote by telephone or by Internet. If you attend the annual meeting, you will have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from your brokerage firm, bank or other nominee to vote your shares.

We look forward to your participation in the annual meeting.

Sincerely,

/s/ Dickerson Wright

Dickerson Wright

Chairman and Chief Executive Officer

| | | | | |

| NOTICE OF 20212023 ANNUAL MEETING OF STOCKHOLDERS |

| |

| Time and Date: | 9:2:00 a.m.p.m., PacificEastern Time, on Saturday,Tuesday, June 5, 2021 virtually on the Internet.13, 2023. |

| |

| Place: | The in-person portion of the annual meeting will be held at 200 South Park Road, Suite 350, Hollywood, Florida 33021. You will also be able to attend the virtual portion of the annual meeting, vote, and submit questions during the meeting by visiting www.meetingcenter.io/291787599.meetnow.global/MWNDH7U. |

| |

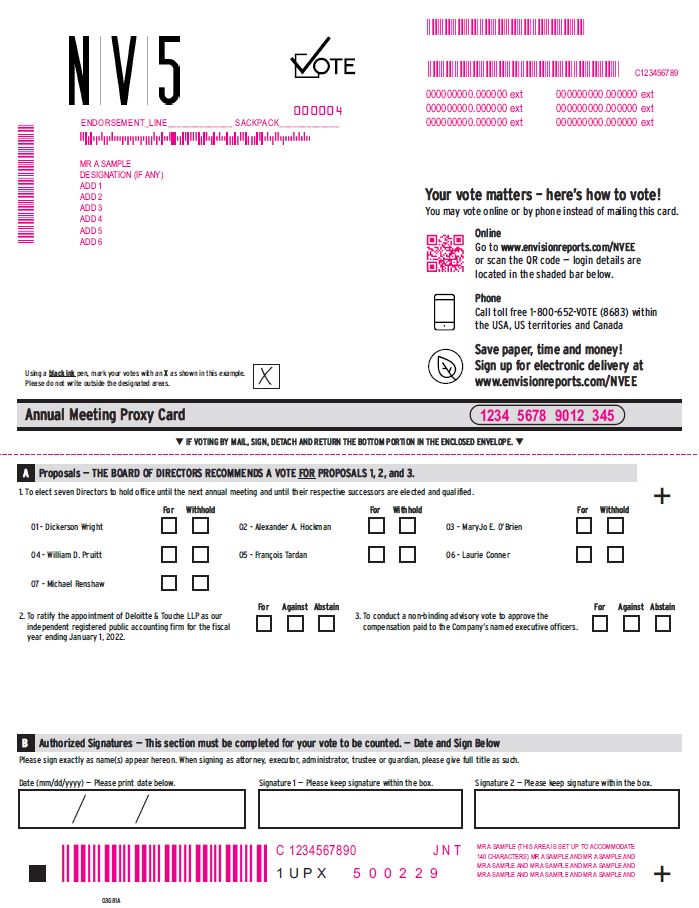

| Items of Business: | (1) To elect seveneight Directors to hold office until the next annual meeting and until their respective successors are elected and qualified. |

| |

| (2) To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022.December 30, 2023. |

| |

| (3) To conduct a non-binding advisory vote to approve the compensation paid to the Company's named executive officers (the "Say on Pay"Say-on-Pay Proposal"). |

| |

| (4) To approve the NV5 Global, Inc. 2023 Equity Incentive Plan. |

| |

| (5) To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

| |

| Adjournments and Postponements: | Any action on the items of business described above may be considered at the 20212023 annual meeting of stockholders (the “2021“2023 Annual Meeting”) at the time and on the date specified above or at any time and date to which the 20212023 Annual Meeting may be properly adjourned or postponed. |

| |

| Record Date: | You are entitled to vote at the 20212023 Annual Meeting and any adjournments or postponements thereof if you were a stockholder at the close of business on Friday,Wednesday, April 9, 202119, 2023 (the “Record Date”). |

| |

| Meeting Admission: | Information regarding attendance, including how to access the virtual portion of the annual meeting, is set forth in the "Questions and Answers About the Proxy Materials and the 20212023 Annual Meeting" section of this proxy statement. |

| |

| Voting: | Your vote is very important. Whether or not you plan to participate in the 20212023 Annual Meeting, we encourage you to read the 20212023 Proxy Statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the enclosed proxy card. |

| |

| List of Stockholders: | For ten days prior to the 20212023 Annual Meeting, a complete list of stockholders entitled to vote at such meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 200 South Park Road, Suite 350, Hollywood, Florida 33021. |

| |

| Recommendation of the Board of Directors: | The Board of Directors of NV5 Global, Inc. recommends a vote “FOR” Proposals 1, 2, 3, and 3.4. |

By order of the Board of Directors,

/s/ MaryJo O’Brien

MaryJo O’Brien

Corporate Secretary

April 23, 2021May 1, 2023

IMPORTANT: Please mark, date and sign the enclosed proxy card and promptly return it in the accompanying postage-paid envelope or vote by telephone or by Internet to assure that your shares are represented at the meeting. If you attend the virtual meeting, you may choose to vote online even if you have previously sent in your proxy card.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SATURDAY,TUESDAY, JUNE 5, 2021:13, 2023: Our 20212023 Proxy Statement is enclosed. Financial and other information concerning NV5 Global, Inc. is contained in our Annual Report to Stockholders for the fiscal year ended January 2, 2021December 31, 2022 (“20202022 Annual Report”). A complete set of proxy materials relating to our 20212023 Annual Meeting, consisting of the Notice of 20212023 Annual Meeting of Stockholders, 20212023 Proxy Statement, proxy card and 20202022 Annual Report, is available on the Internet and may be viewed at http://www.edocumentview.com/NVEE.

Table of Contents

| | | | | |

| Page |

| |

| |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE 20212023 ANNUAL MEETING | |

| |

| |

Attending the 20212023 Annual Meeting | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| |

| |

PROPOSAL NO.3NO. 3 | |

| PROPOSAL NO. 4 | |

| |

| |

| |

| |

200 South Park Road, Suite 350

Hollywood, Florida 33021

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE 20212023 ANNUAL MEETING

Proxy Materials

Why am I receiving these materials?

The Board of Directors (the “Board”) of NV5 Global, Inc. (the “Company” or “NV5”) has made these proxy materials available to you on the Internet, or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the solicitation of proxies for use at the Company’s 20212023 Annual meeting of stockholders (the “2021“2023 Annual Meeting”), which will take place on Saturday,Tuesday, June 5, 202113, 2023 at 9:2:00 a.m.p.m., PacificEastern Time, as a virtualhybrid meeting both in-person and conducted via live webcast.

As a stockholder, you are invited to participate in the 20212023 Annual Meeting and are requested to vote on the proposals described in this 20212023 Proxy Statement (the “2021“2023 Proxy Statement”). This 20212023 Proxy Statement includes information that we are required to provide to you under Securities and Exchange Commission (“SEC”) rules and is designed to assist you in voting your shares.

What is included in these materials?

The proxy materials include:

•our 20212023 Proxy Statement for the 20212023 Annual Meeting;

•our annual report to stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended January 2, 2021December 31, 2022 (the “2020“2022 Annual Report”); and

•the proxy card or a voting instruction card for the 20212023 Annual Meeting.

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this 20212023 Proxy Statement and our 20202022 Annual Report, to our stockholders by providing access to such documents over the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”), which was mailed to most of our stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. If you would like to receive a paper copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice of Internet Availability.

How can I access the proxy materials over the Internet?

The Notice of Internet Availability, proxy card or voting instructions card will contain instructions on how to:

•access and view our proxy materials for the 20212023 Annual Meeting over the Internet; and

•how to vote your shares.

If you choose to receive our future proxy materials electronically, it will save us the cost of printing and mailing documents to you and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials electronically, you will receive an e-mail next year with instructions containing a link to the website where those materials are available. Your election to receive proxy materials electronically will remain in effect until you terminate it.

How may I obtain a paper copy of the proxy materials?

Stockholders receiving a Notice of Internet Availability will find instructions in that notice about how to obtain a paper copy of the proxy materials. Stockholders receiving a Notice of Internet Availability by e-mail will find instructions in that e-mail about how to obtain a paper copy of the proxy materials. Stockholders who have previously submitted a standing request to receive paper copies of our proxy materials will receive a paper copy of the proxy materials by mail.

What shares are included on the proxy card?

If you are a stockholder of record, you will receive only one proxy card for all the shares you hold of record in certificate form and in book-entry form.

If you are a beneficial owner, you will receive voting instructions from your broker, bank or other holder of record.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Notice of 20212023 Annual Meeting of Stockholders, 20212023 Proxy Statement and 20202022 Annual Report, unless we are notified that one or more of these stockholders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Stockholders who participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Notice of 20212023 Annual Meeting of Stockholders, 20212023 Proxy Statement and 20202022 Annual Report, or if you hold stock of the Company in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact the Corporate Secretary of the Company by sending a written request to NV5 Global, Inc., Corporate Secretary, 200 South Park Road, Suite 350, Hollywood, Florida 33021, or by calling (954) 495-2112.

If you participate in householding and wish to receive, free of charge, a separate copy of the Notice of 20212023 Annual Meeting of Stockholders, 20212023 Proxy Statement and 20202022 Annual Report, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact the Corporate Secretary of the Company, as set forth above.

If you are a beneficial owner, you can request information about householding from your broker, bank or other holder of record.

Voting Information

What items of business will be voted on at the 20212023 Annual Meeting?

The items of business scheduled to be voted on at the 20212023 Annual Meeting are:

1.To elect seveneight Directors to hold office until the next annual meeting and until their respective successors are elected and qualified.

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022.December 30, 2023.

3.To conduct a non-binding advisory vote to approve the compensation paid to the Company's named executive officers (the "Say on Pay"Say-on-Pay Proposal").

4.To approve the NV5 Global, Inc. 2023 Equity Incentive Plan (the "2023 Equity Incentive Plan Proposal").

We will also consider any other business that properly comes before the 20212023 Annual Meeting.

How does the Board recommend that I vote?

The Board unanimously recommends that you vote your shares:

•“FOR” the election of each of the nominees for Director listed in Proposal No. 1.

•“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022.December 30, 2023.

•"FOR" the non-binding advisory vote to approve the compensation of our named executive officers.

•"FOR" the approval of the NV5 Global, Inc. 2023 Equity Incentive Plan.

Who is entitled to vote at the 20212023 Annual Meeting?

Only stockholders of record at the close of business on Friday,Wednesday, April 9, 202119, 2023 (the “Record Date”) will be entitled to vote at the 20212023 Annual Meeting. As of the Record Date, 14,934,95115,708,193 shares of the Company’s common stock were outstanding and entitled to vote. Each share of our common stock outstanding on the Record Date is entitled to one vote on each of the seveneight Director nominees and one vote on each other matter.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the 20212023 Annual Meeting will be available online at the 2021virtual portion of the 2023 Annual Meeting. We will also make a list of these stockholders available for ten days prior to the 20212023 Annual Meeting between the hours of 9:00 a.m. and 4:30 p.m., local time, at our principal executive offices at 200 South Park Road, Suite 350, Hollywood, Florida 33021. If you would like to examine the list for any purpose germane to the 20212023 Annual Meeting prior to the meeting date, please contact our Corporate Secretary.

How can I vote if I own shares directly?

Most stockholders do not own shares registered directly in their name, but rather are “beneficial holders” of shares held in a stock brokerage account or by a bank or other nominee (that is, shares held “in street name”). Those stockholders should refer to “How can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?” below for instructions regarding how to vote their shares.

If, however, your shares are registered directly in your name with our transfer agent, Computershare, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you. You may vote in the following ways:

•By Mail: Votes may be cast by mail, as long as the proxy card or voting instruction card is delivered in accordance with its instructions prior to 4:00 p.m., Eastern Time, on Friday,Monday, June 4, 2021.12, 2023. Stockholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies by completing, signing and dating their proxy card or voting instruction card and mailing it in the accompanying pre-addressed envelope.

•By Attending the Meeting: Please follow the instructions in the "How can I participate and vote in the 20212023 Annual Meeting" section of this proxy statement.

•By Phone or Internet: Stockholders may vote by phone or Internet by following the instructions included in the proxy card they received.

Whichever method you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions.

If you vote by mail without giving specific voting instructions, your shares will be voted:

•“FOR” Proposal No. 1 – Election of the seveneight Director nominees named herein to the Board of Directors.

•“FOR” Proposal No. 2 – Ratification of the appointment of our independent registered public accounting firm.

•“FOR” Proposal No. 3 – The non-binding advisory vote to approve the compensation of our named executive officers.

•"FOR" Proposal No. 4 – The approval of the NV5 Global, Inc. 2023 Equity Incentive Plan.

If no specific instructions are given, the shares will be voted in accordance with the recommendation of our Board and as the proxy holders may determine in their discretion with respect to any other matters that properly come before the meeting.

How can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name,” and your broker or nominee is considered the “stockholder of record” with respect to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote, and you are also invited to participate in the 20212023 Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person unless you obtain a legal proxy from your brokerage firm or bank. If a broker, bank or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted.

What is a quorum for the Annual Meeting?

The presence of the holders of stock representing a majority of the voting power of all shares of stock issued and outstanding as of the Record Date, represented in person or by proxy, is necessary to constitute a quorum for the transaction of business at the 20212023 Annual Meeting. In accordance with Delaware law, the board of directors has authorized that the annual meeting be held via virtualas a hybrid meeting, and accordingly, stockholders and proxy holders virtually attending the virtual portion of the annual meeting are deemed present in person for purposes of determining the presence of a quorum.quorum in addition to those attending the in-person portion of the annual meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker) or if you participate in, and vote electronically at, the 20212023 Annual Meeting. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum.

What is the voting requirement to approve each of the proposals?

| | | | | | | | | | | | | | |

Proposal | | Vote Required | | Broker Discretionary Voting Allowed |

| No. 1 - Election of Directors | | Director nominees receiving the highest number of “FOR” votes | | No |

| No. 2 - Ratification of Appointment of Deloitte & Touche LLP | | Majority vote of shares present and entitled to vote in person or by proxy | | Yes |

No. 3 - Say on PaySay-on-Pay Proposal | | Majority vote of shares present and entitled to vote in person or by proxy | | No |

| No. 4 - 2023 Equity Incentive Plan | | Majority vote of shares present and entitled to vote in person or by proxy | | No |

For the election of Directors, the seveneight Director nominees who receive the highest number of “FOR” votes will be elected as Directors. You may vote “FOR” or “WITHHOLD” with respect to each Director nominee. Votes that are withheld will be excluded entirely from the vote with respect to the nominee from which they are withheld and will have the same effect as an abstention. The ratification of the appointment Deloitte & Touche LLP, the Say-on-Pay Proposal, and the Say on Pay Proposalapproval of the NV5 Global, Inc. 2023 Equity Incentive Plan each requires the affirmative vote of a majority of the shares present and entitled to vote either in person or by proxy.

What is the effect of abstentions and broker non-votes?

Shares not present at the meeting and shares voted “WITHHOLD” will have no effect on the election of Directors. For the ratification of the appointment of Deloitte & Touche LLP, the 2023 Equity Incentive Plan Proposal, and the Say on PaySay-on-Pay Proposal, abstentions will have the same effect as an “AGAINST” vote while broker non-votes will not be counted as votes cast and, accordingly, will not have an effect on such matters. If you are a beneficial owner and hold your shares in “street name” in an account at a bank or brokerage firm, it is critical that you cast your vote if you want it to count in the election of Directors, the approval of the 2023 Equity Incentive Plan Proposal, or the Say on PaySay-on-Pay Proposal. Under the rules governing banks and brokers who submit a proxy card with respect to shares held in “street name,” such banks and brokers have the discretion to vote on routine matters, but not on non-routine matters. Routine matters include the ratification of auditors. Non-routine matters include the election of Directors, the approval of the 2023 Equity Incentive Plan Proposal, and advisory votes such as the Say on PaySay-on-Pay Proposal. Banks and brokers may not vote on the election of Directors proposal, the 2023 Equity Incentive Plan Proposal, or the Say on PaySay-on-Pay Proposal if you do not provide specific voting instructions. Accordingly, we encourage you to vote promptly, even if you plan to participate in the 20212023 Annual Meeting. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

Can I change my vote or revoke my proxy?

Subject to any rules and deadlines your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy is voted at the 20212023 Annual Meeting. If you are a stockholder of record, you may change your vote byby: (1) delivering to the Company’s Corporate Secretary, prior to your shares being voted at the 20212023 Annual Meeting, a written notice of revocation dated later than the prior proxy card relating to the same shares, (2) delivering a valid, later-dated proxy in a timely manner, (3) attending the 20212023 Annual Meeting and voting electronically (although attendance at either the 2021in-person or virtual portions of the 2023 Annual Meeting will not, by itself, revoke a proxy), or (4) voting again via phone or Internet at a later date.

If you are a beneficial owner of shares held in street name, you may change your votevote: (1) by submitting new voting instructions to your broker, trustee or other nominee, or (2) if you have obtained a legal proxy from the broker, trustee or other nominee that holds your shares giving you the right to vote the shares and provided a copy to Computershare together with your email address as described below, by attending the 20212023 Annual Meeting and voting electronically.

Any written notice of revocation or subsequent proxy card must be received by the Company’s Corporate Secretary prior to the taking of the vote at the 20212023 Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to the Company’s Corporate Secretary.

Who will count the votes?

Our Corporate Secretary and General Counsel will tabulate the votes and act as inspectors of election.

Where can I find the voting results of the 20212023 Annual Meeting?

We intend to announce preliminary voting results at the 20212023 Annual Meeting and publish final results in a Current Report on Form 8-K report to be filed with the SEC within four business days of the 20212023 Annual Meeting.

Participating in the 20212023 Annual Meeting

How can I participate and vote in the 20212023 Annual Meeting?

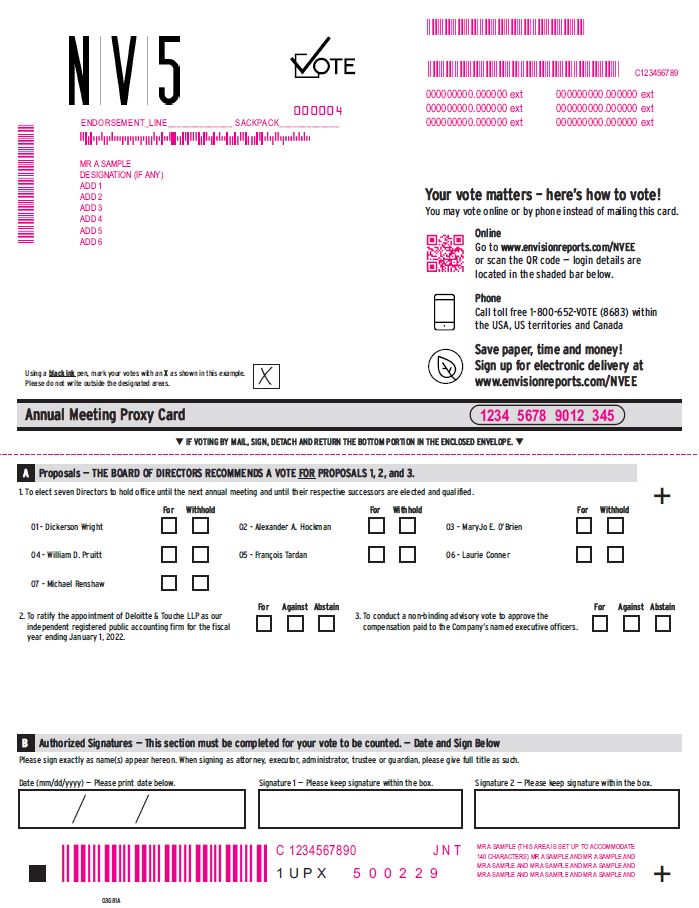

Virtual Portion

Stockholders of record at the close of business on Friday,Wednesday, April 9, 202119, 2023 will be able to attend the 2021virtual portion of the 2023 Annual Meeting, vote, and submit questions during the 20212023 Annual Meeting by visiting www.meetingcenter.io/291787599 meetnow.global/MWNDH7U at the meeting date and time. We encourage you to access the 2021virtual portion of the 2023 Annual Meeting prior to the start time; online access will begin at 8:1:30 a.m.p.m., PacificEastern Time. The two itemsone item of information needed to access the virtual annual meeting from the website areis as follows:

Username: the 15-digit control number located in the shaded bar on the Notice you receive or on the proxy card.

Meeting password: NVEE2021

Have the Notice or proxy card in hand when you access the website and then follow the instructions. If you are a stockholder of record, you are already registered for the virtual meeting.portion of the 2023 Annual Meeting. If you hold your shares beneficially in street name, you must register in advance to attend the virtual meeting,portion of the 2023 Annual Meeting, vote, and submit questions. To register in advance you must obtain a legal proxy from the broker, bank, or other nominee that holds your shares giving you the right to vote the shares. You must forward a copy of the legal proxy along with your email address to Computershare. Requests for registration should be directed to:

Computershare

NV5 Global Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Requests for registration must be labeled as "Legal Proxy" and be received no later than 5:00 p.m., Eastern Time, on May 28, 2021. June 6, 2023. Even if you plan to attend the virtual meeting,portion of the 2023 Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

Stockholders of record and beneficial owners who duly registered to attend the annual meetingvirtual portion of the 2023 Annual Meeting will be able to vote their shares and submit questions at any time during the virtual meeting2023 Annual Meeting by following the instructions on the website referenced above.

If you have technical difficulties or trouble accessing the virtual meeting at any time after online access commences at 8:1:30 a.m.p.m., PacificEastern Time, on the date of the annual meeting,2023 Annual Meeting, please access the support link provided on the website referenced above.

In-Person Portion

You are entitled to attend the in-person portion of the 2023 Annual Meeting only if you were a stockholder of the Company as of the Record Date. You should be prepared to present photo identification for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you must also provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to the Record Date, a copy of the voting instruction card provided by your broker, bank, trustee or nominee and a legal proxy from the broker, bank, or other nominee that holds your shares giving you the right to vote the shares.

If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the in-person portion of the 2023 Annual Meeting. For security reasons, you and your bags may be subject to search prior to your admittance to the in-person portion of the 2023 Annual Meeting.

What happens if additional matters are presented at the 20212023 Annual Meeting?

If any other matters are properly presented for consideration at the 20212023 Annual Meeting, including, among other things, consideration of a motion to adjourn the 20212023 Annual Meeting to another time or venue (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. The Company does not currently anticipate that any other matters will be raised at the 20212023 Annual Meeting.

Who will bear the cost of soliciting votes for the 20212023 Annual Meeting?

The Company will bear the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. If you access the proxy materials over the Internet, you are responsible for Internet access charges you may incur. In addition, we will request banks, brokers and other intermediaries holding shares of our common stock beneficially owned by others to obtain proxies from the beneficial owners and will reimburse them for their reasonable expenses in so doing. Solicitation of proxies by mail may be supplemented by telephone, by electronic communications and personal solicitation by our officers, Directors and employees. No additional compensation will be paid to our officers, Directors or employees for such solicitation.

CORPORATE GOVERNANCE

Corporate Governance Philosophy

The business affairs of the Company are managed under the direction of our Chief Executive Officer and the oversight of our Board in accordance with the Delaware General Corporation Law, as implemented by the Company’s Amended and Restated Certificate of Incorporation and Bylaws. The fundamental role of the Board is to effectively govern the affairs of the Company in the best interests of the Company and our stockholders. The Board strives to ensure the success and continuity of our business through the selection of qualified management. It is also responsible for ensuring that the Company’s activities are conducted in a responsible and ethical manner. The Company is committed to having sound corporate governance principles.

Director Qualification Standards and Review of Director Nominees

The Nominating and Governance Committee (the “Governance Committee”) makes recommendations to the Board regarding the size and composition of the Board. The Governance Committee is responsible for screening and reviewing potential Director candidates and recommending qualified candidates to the Board for nomination. The Governance Committee considers recommendations of potential candidates from current Directors, management and stockholders. Stockholders’ nominees for Directors must be made in writing and include the nominee’s written consent to the nomination and sufficient background information on the candidate to enable the Governance Committee to assess his or her qualifications. Nominations from stockholders must be addressed and received in accordance with the instructions set forth under “Stockholder Proposals or Nominations to be Presented at Next Annual Meeting” later in this 20212023 Proxy Statement in order to be included in the proxy statement relating to the next annual election of Directors.

Criteria for Board of Directors Membership

The Nominating and Governance Committee is responsible for reviewing with the Board, from time to time, the appropriate skills and characteristics required of Board members in the context of the current size and composition of the Board. This assessment includes issues of diversity and numerous other factors, such as skills, background, experience and expected contributions in areas that are relevant to the Company’s activities. These factors, and any other qualifications considered useful by the Nominating and Governance Committee, are reviewed in the context of an assessment of the perceived needs of the Board as a whole when the Nominating and Governance Committee recommends candidates to the Board for nomination. As a result, the priorities and emphasis that the Nominating and Governance Committee, and the Board, places on various selection criteria may change from time to time to take into account changes in business and other trends, and the portfolio of skills and experience of current and prospective members of the Board. Therefore, while focused on the achievement and the ability of potential candidates to make a positive contribution with respect to such factors, the Nominating and Governance Committee has not established any specific minimum criteria or qualifications that a nominee must possess. In addition, the Nominating and Governance Committee and the Board are committed to considering candidates for the Board regardless of gender, ethnicity and national origin. While the Company does not haveorigin and seeks individuals of diverse ethnicities, a specific policy regarding diversity, when considering the nomination of Directors, the Governance Committee does consider the diversity of its Directors and nomineesbalance in terms of knowledge, experience, background, skills, expertisegender, and individuals with diverse perspectives informed by other demographic factors.personal and professional experiences. We believe that the considerations and the flexibility of our nomination process have created Board diversity of a type that is effective for our Company.

Director Independence

The Board has determined that, other than Mr. Dickerson Wright, our Chairman and Chief Executive Officer, Mr. Alexander A. Hockman, our Chief Operating Officer, President and a Director, and Ms. MaryJo O’Brien, our Executive Vice President, Chief Administrative Officer and a Director, each of the members of the Board is an “independent director” for purposes of the NASDAQ Stock Market (“NASDAQ”) Listing Rules and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as the term applies to membership on the Board and the various committees of the Board. NASDAQ’s independence definition includes a series of objective tests, such as that the Director has not been an employee of the company within the past three years and has not engaged in various types of business dealings with the Company. In addition, as further required by NASDAQ Listing Rules, our Board has made an affirmative subjective determination as to each independent Director that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director. In making these determinations, the Board reviewed and discussed information provided by the Directors and us with regard to each Director’s business and personal activities as they may relate to the Company and the Company’s management. On an annual basis, each Director and executive officer is obligated to complete a Director and Officer Questionnaire that requires disclosure of any transactions with the Company in which the Director or executive officer, or any member of his or her family, have a direct or indirect material interest.

Based upon all of the elements of independence set forth in the NASDAQ Listing Rules, the Board has determined that each of the following non-employee Directors is independent and has no relationship with the Company, except as a Director and stockholder of the Company: Messrs. William D. Pruitt and François Tardan, and Ms. Laurie Conner. Mr. Gerald J. Salontai, who resigned from his position from a member of the Board in September 2020, was also determined to be independent during his time serving on the Board.Conner, and Dr. Denise Dickins. The Board has determined that Mr. Michael Renshaw,Brian C. Freckmann, candidate for election as a Director, will qualify as a non-employee "independent director" for purposes of the NASDAQ Listing Rules and Rule 10A-3(b)(1) under the Exchange Act with no relationship with the Company, except as a Director and stockholder of the Company, should he be elected at the 20212023 Annual Meeting.

Board of Directors Leadership Structure

`

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board understands that there is no single, generally accepted approach to providing Board leadership, and that given the dynamic and competitive environment in which we operate, the right Board leadership structure may vary as circumstances warrant. Our Corporate Governance Guidelines currently provide that the Board may choose to appoint a single person to a combined Chief Executive Officer and Chairman role or appoint a Chairman who does not also serve as Chief Executive Officer. Currently, our Chief Executive Officer also serves as Chairman and, as discussed below, our independent Directors also elect a Lead Independent Director. The Board believes this leadership structure is optimal for the Company at the current time, as it provides the Company with a Chief Executive Officer and Chairman with a long history of service in a variety of positions and who is, therefore, deeply familiar with the history and operations of the Company. The

Board also believes that the current leadership structure provides independent oversight and management accountability through regular executive sessions of the independent Directors that are mandated by our Corporate Governance Guidelines and which are chaired by the Lead Independent Director, as well as through a Board composed of a majority of independent Directors.

Lead Independent Director

Mr. Gerald SalontaiWilliam D. Pruitt was previously elected by our independent Directors to serve as the Lead Independent Director, and he has served in such capacity from June 8, 2019 until his resignation insince September 2020. Following Mr. Salontai's resignation, our independent directors appointed Mr. William D. Pruitt to serve as the Lead Independent Director. TheAs Lead Independent Director, is responsibleMr. Pruitt has the following duties and responsibilities:

•Advise the Chairman as to an appropriate schedule of Board meetings.

•Review and provide the Chairman with input regarding the agendas for among other things, presiding over periodicthe Board meetings.

•Be available for direct communication with the Company's shareholders.

•Call meetings of ourthe independent Directors and overseeingdirectors when necessary or appropriate.

•Perform such other duties as the function of our Board and committees of the Board.may from time to time determine necessary.

Executive Sessions

Our independent Directors meet periodically in executive session, without the presence of management, including the Chief Executive Officer, who is one of our three current Directors who are not independent.session. Generally, executive sessions are scheduled as a part of all regular Board meetings, and, in any event, such sessions are held not less than twice during each

calendar year. Executive sessions are chaired by our Lead Independent Director. The Chairman of each executive session will report to the Chief Executive Officer, as appropriate, regardingDirector who reports relevant matters discussed in the executive session.session to the Chief Executive Officer.

Board of Director’s Role in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. In particular,An Enterprise Risk Management (ERM) process has been implemented which is managed by key senior management. While our Board is responsible for monitoring and assessing strategic risk exposure, it has delegated responsibility related to certain risks to the Audit, Compensation, and ourNominating and Governance Committees. Our Audit Committee has the responsibility to consider and discuss our majorsignificant financial, risk exposuresoperational, compliance, reputational, strategic, cybersecurity, and environmental, social and governance risks that could have a material impact on the Company’s financial statements or SEC filings, as well as the steps our management has taken to monitor and control these exposures. The Audit Committee also hassuch exposures to be within the responsibilityCompany’s risk tolerance, and to issue guidelinescomply with applicable laws and policiesregulations, and to govern the process by which risk assessment and management is undertaken, monitor compliance with legal and regulatory requirements, and oversee the performance of our internal audit function as well as cyber-security measures to address risks to our information technology systems, networks and infrastructure from deliberate attacks or unintentional events that could interrupt or interfere with their functionality or the confidentiality of our information. Mr. William D. Pruitt was appointed by the Audit Committee of the Board as the Audit Committee member with primary risk oversight responsibility for cybersecurity issues.function. Our Governance Committee monitors the effectiveness of our Corporate Governance Guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitorshas responsibility to determine whether any of our compensationcompensation-related practices, policies, and programs have the potential to encourage unnecessary or excessive risk-taking.risk taking.

Board of Director’s Role in Succession Planning

As provided in our Corporate Governance Guidelines, the Board is responsible for planning for the succession of the position of Chief Executive Officer and other senior management positions. To assist the Board, the Chief Executive Officer shall report periodically to the Board on succession planning. The independent Directors shall consult with the Chief Executive Officer toto: (1) develop plans for interim succession of the Chief Executive Officer in the event that such officer should become unable to perform his or her duties, and (2) assess the qualification of senior officers as potential successors to the Chief Executive Officer.

Stockholder Communications with Directors

Stockholders who wish to communicate with the Board or an individual Director may do so by sending written correspondence by mail, facsimile or email to: the Board or individual Director, c/o the Corporate Secretary of the Company at 200 South Park Road, Suite 350, Hollywood, FL 33021; Fax: (954) 495-2102; Email Address: MaryJo.OBrien@nv5.com. The mailing envelope, facsimile cover letter or email must contain a clear notation indicating that the enclosed correspondence is a “Stockholder Board Communication.” The Corporate Secretary has been authorized to screen such communications and handle differently any such communications that are abusive, in bad taste or that present safety or security concerns. All such communications must identify the author as a stockholder and clearly state whether the intended recipients are all or individual members of the Board. The Corporate Secretary will maintain a log of such communications and make copies of all such communications and circulate them to the full Board or the appropriate Directors.

Indemnification of Directors and Officers

As required by our Amended and Restated Certificate of Incorporation and Bylaws, we indemnify our Directors and officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection with their service to the Company. We also have entered into agreements with our Directors and officers that contractually obligate us to provide this indemnification.

Policies on Business Conduct and Ethics

All of our employees, including our Chief Executive Officer, Chief Financial Officer, and controller, are required to abide by our Code of Business Conduct and Ethics to ensure that our business is conducted in a consistently legal and ethical manner. These policies form the foundation of a comprehensive process that includes compliance with corporate policies and procedures, an open relationship among colleagues that contributes to good business conduct, and a commitment to honesty, fair dealing and full compliance with all laws and regulations affecting the Company’s business. Our policies and procedures cover all major areas of professional conduct, including employment policies, conflicts of interest, intellectual property and the protection of confidential information, as well as strict adherence to laws and regulations applicable to the conduct of our business.

Employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of our Code of Business Conduct and Ethics. As required by the Sarbanes-Oxley Act of 2002, our Audit Committee has procedures to receive, retain, and treat complaints received regarding accounting, internal accounting controls, or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The full text of our Code of Business Conduct and Ethics is posted on the “Investors - Corporate Governance” page of our website at www.nv5.com.

We will disclose any future amendments to, or waivers from, provisions of these ethics policies and standards on our website as promptly as practicable, as may be required under applicable SEC and NASDAQ rules and, to the extent required, by filing Current Reports on Form 8-K with the SEC disclosing such information.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines that address the composition of the Board, criteria for Board membership and other Board governance matters. These guidelines are available on our website at www.nv5.com on the “Investors - Corporate Governance” page.

Anti-Hedging Policy

We have adopted an insider trading policy that includes an anti-hedging provision restricting the circumstances under which our employees may engage in short sales, maintain shares of our common stock in margin accounts and engage in certain hedging transactions – including zero-cost collars and forward sale contracts – that have the economic effect of locking in a particular value in exchange for future appreciation.

Board and Committee Membership

Meetings of the Board of Directors and Committees

The Board held five (5)seven (7) meetings during the fiscal year ended January 2, 2021.December 31, 2022. The Board has three standing committees: the Audit Committee, Compensation Committee, and Nominating and Governance Committee. During fiscal year 2020,2022, each of our Directors attended at least 75% of the total number of meetings of the Board and at least 75% of the total number of meetings of the committees of the Board on which such Director served during that period. Mr. Gerald Salontai,William D. Pruitt, our former Lead Independent Director, presided over all executive sessions of our Directors prior to his resignation in September 2020. Our independent directors have appointed Mr. William D. Pruitt to serve as the Lead Independent Director following Mr. Salontai's resignation and Mr. Pruitt has presided over all subsequent executive sessions of our Directors.

The table below provides membership and meeting information for each of the committees of the Board for fiscal year 2020.2022.

| | Director | Director | | Audit

Committee | | Compensation

Committee | | Nominating and Governance

Committee | Director | | Audit

Committee | | Compensation

Committee | | Nominating and Governance

Committee |

| Dickerson Wright | Dickerson Wright | | - | | - | | - | Dickerson Wright | | - | | - | | - |

| Alexander A. Hockman | Alexander A. Hockman | | - | | - | | - | Alexander A. Hockman | | - | | - | | - |

| MaryJo O’Brien | MaryJo O’Brien | | - | | - | | - | MaryJo O’Brien | | - | | - | | - |

| Laurie Conner | Laurie Conner | | - | | X | | Chairman | Laurie Conner | | - | | X | | Chair |

| William D. Pruitt | William D. Pruitt | | Chairman | | Chairman(1) | | X | William D. Pruitt | | Chair | | X | | X |

Gerald J. Salontai(1) | | X | | Chairman | | X | |

| Denise Dickins | | Denise Dickins | | X | | Chair | | X |

| François Tardan | François Tardan | | X | | - | | - | François Tardan | | X | | - | | - |

Total meetings during

fiscal year 2020 | | 5 | | 2 | | 2 | |

Total meetings during

fiscal year 2022 | | Total meetings during

fiscal year 2022 | | 4 | | 7 | | 3 |

(1) Mr. Salontai resigned from the Board in September 2020 and as a result ceased to serve as a member of the Audit Committee and Nominating and Governance Committee and chairman of the Compensation Committee. Mr. Pruitt has served as the Chairman of the Compensation Committee following Mr. Salontai's resignation. The Nominating and Governance Committee has recommended Mr. Michael Renshaw,Brian C. Freckmann, candidate for election as Director, to serve as a member of the AuditNominating and Governance Committee following his election at the 2023 Annual Meeting.

Board Diversity

The following Board Diversity Matrix presents our Board diversity statistics in accordance with Nasdaq Rule 5606. The information is based on our directors' self-reporting and reflects compliance with the Compensation Committee.objectives of Nasdaq Rule 5605(f)(3) by having at least one diverse director by December 31, 2023. As we pursue future Board recruitment efforts, our Nominating and Governance Committee will continue to see candidates who can contribute to the diversity of views and perspectives of the Board. This includes seeking out individuals of diverse ethnicities, a balance in terms of gender, and individuals with diverse perspectives informed by other personal and professional experiences.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (As of May 1, 2023) |

| Board Size: | | | | | | | | |

| Total Number of Directors | 7 |

| | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | 3 | | 4 | | — | | — |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | | — | | — | | — | | — |

| Alaskan Native or Native American | | — | | — | | — | | — |

| Asian | | — | | — | | — | | — |

| Hispanic or Latin | | — | | — | | — | | — |

| Native Hawaiian or Pacific Islander | | — | | — | | — | | — |

| White | | 3 | | 4 | | — | | — |

| Two or More Races or Ethnicities | | — | | — | | — | | — |

| LGBTQ+ | | — | | — | | — | | — |

| Did Not Disclose Demographic Background | | — | | — | | — | | — |

Audit Committee

The members of the Audit Committee are Messrs. William D. Pruitt (Chairman)(Chair), François Tardan, and François Tardan. Gerald J. Salontai served on the Audit Committee prior to his resignation from the Board in September 2020. The Nominating and Governance Committee has recommended Mr. Michael Renshaw, candidate for election as a Director, to serve as a member of the Audit Committee following his election at the 2021 Annual Meeting to fill the vacancy caused by Mr. Salontai's resignation.Dr. Denise Dickins. Each of the members of the Audit Committee is independent for purposes of the NASDAQ Listing Rules and meets the independence standard for audit committee members set out in Rule 10A-3(b)(1) of the Exchange Act. The Board has determined that Mr. William D. Pruitt qualifies

All Audit Committee members possess the required level of financial literacy as an auditdefined in our Audit Committee charter, and all Audit Committee members qualify as "audit committee financial expert underexperts" as defined by applicable Securities & Exchange Commission (referred to as the SEC) rules and regulations and meet the current standard of the SEC.requisite financial management expertise and independence as required by NASDAQ Listing Rules and applicable SEC rules and regulations. The functions of the Audit Committee include retaining our independent registered public accounting firm, reviewing its independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our independent registered public accounting firm, overseeing its audit work, reviewing and pre-approving any non-audit services that may be performed by our independent registered public accounting firm, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies, and reviewing and approving any related party transactions. Additional information regarding the Audit Committee is set forth in the Report of the Audit Committee immediately following Proposal No. 2 of this 20212023 Proxy Statement.

Compensation Committee

The members of the Compensation Committee are Dr. Denise Dickins (Chair), Mr. William D. Pruitt, (Chairman) and Ms. Laurie Conner. Gerald J. Salontai served as Chairman of the Compensation Committee prior to his resignation from the Board in September 2020. The Nominating and Governance Committee has recommended Mr. Michael Renshaw, candidate for election as a Director, to serve as a member of the Compensation Committee following his election at the 2021 Annual Meeting to fill the vacancy caused by Mr. Salontai's resignation. Each of the members of the Compensation Committee is independent for purposes of the NASDAQ Listing Rules. The Compensation Committee is responsible for the design and oversight of our compensation program and policies for our executive officers and non-employee Directors. The Compensation Committee seeks to ensure that the executive pay program reinforces the Company’s compensation philosophy and aligns with the interests of our stockholders. The Compensation Committee also reviews and approves all equity grants under the Company’s 2011 Equity Incentive Plan (as amended, the “2011 Equity Incentive Plan”) and the Company’s Employee Stock Purchase Plan. The Compensation Committee also periodically monitors any potential risks associated with the Company’s compensation program and policies.

Nominating and Governance Committee

The members of the Nominating and Governance Committee are Ms. Laurie Conner (Chairman) and(Chair), Mr. William D. Pruitt. Gerald J. Salontai served onPruitt, and Dr. Denise Dickins. The Nominating and Governance Committee has recommended Mr. Brian C. Freckmann, candidate for election as a Director, to serve as a member of the AuditNominating and Governance Committee prior tofollowing his resignation fromelection at the Board in September 2020.2023 Annual Meeting. Each of the members of the Nominating and Governance Committee is independent for purposes of the NASDAQ Listing Rules. The Nominating and Governance Committee considers qualified candidates for appointment and nomination for election to the Board and makes recommendations concerning such candidates, develops corporate governance principles for recommendation to Board, and oversees the regular evaluation of our Directors and management.

Committee Charters

Our Board has adopted a written charter for each of the Audit Committee, Compensation Committee, and Nominating and Governance Committee. Each charter is available on our website at www.nv5.com on the “Investors - Corporate Governance” page.

Director Participation at Annual Meetings

We attempt to schedule our annual meeting of stockholders at a time and date to accommodate attendance by Directors at an in-person meeting or participation in a virtual meeting, taking into account the Directors’ schedules. All Directors are encouraged to participate in the Company’s annual meeting of stockholders absent an unavoidable and irreconcilable conflict. All of the Directors serving at the time of the 20202022 annual meeting of stockholders attended such meeting. All of our DirectorsDirector candidates and candidates for re-election, as the case may be, are expected to participate in the 20212023 Annual Meeting.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a Board currently consisting of seven Directors, with six current Directors and one vacancy.Directors. There are seveneight nominees for Director to be voted on at the 20212023 Annual Meeting. All of the nominees which are current Directors have consented to serve as Directors. Additionally, Mr. Michael RenshawBrian C. Freckmann has consented to serve as a Director, subject to his election at the 20212023 Annual Meeting. Each Director to be elected will hold office until the next annual meeting and until his or her respective successor is elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate. Should a nominee become unable to serve or should a vacancy on the Board occur before the 20212023 Annual Meeting, the Board may either reduce its size or designate a substitute nominee. If a substitute nominee is named, your shares will be voted for the election of the substitute nominee designated by the Board. In the vote on the election of the Director nominees, stockholders may vote “FOR” nominees or “WITHHOLD” votes from nominees. The seveneight Director nominees receiving the highest number of “FOR” votes will be elected as Directors. Votes that are withheld, abstentions and broker non-votes will have no effect on the outcome of the election.

The persons appointed by the Board as proxies intend to vote for the election of each of the below Director nominees, unless you indicate otherwise on the proxy or voting instruction card.

Set forth below is biographical and other information about the Director nominees. Following each nominee’s biographical information, we have provided information concerning the particular experience, qualifications, attributes and/or skills that led the Governance Committee and the Board to determine that each nominee should serve as a Director.

Our Board unanimously recommends that you vote “FOR” the nominees named below.

Director Nominees

| | | | | | | | | | | |

| Name | Age | Position | Director Since |

| Dickerson Wright | 7476 | Chief Executive Officer and Chairman | September 2011 |

| Alexander A. Hockman | 6365 | Chief Operating Officer, President and Director | January 2015 |

| MaryJo E. O’Brien | 5860 | Director, Executive Vice President, Chief Administrative Officer and Secretary | June 9, 2018 |

| William D. Pruitt | 8082 | Director | March 2013 |

| François Tardan | 6870 | Director | January 2015 |

| Laurie Conner | 6668 | Director | June 2019 |

Michael RenshawDenise Dickins | 4961 | Director | August 2021 |

| Brian C. Freckmann | 45 | Director | Candidate for Director |

Dickerson Wright. Mr. Wright has served as Chief Executive Officer and Chairman of the Board of Directors since the Company’s inception in September 2011. Mr. Wright previously served as our President from 2011 until January 1, 2015. Prior to the Company’s inception, Mr. Wright founded NV5 Holdings, Inc. (formerly known as NV5 Global, Inc. and NV5, Inc.), a Delaware corporation and wholly owned subsidiary of ours, in December 2009 and has served as its Chief Executive Officer, President and Chairman of the Board since its inception in December 2009.

Qualifications: Mr. Wright has over 40 years of uninterrupted experience in managing and developing engineering companies. From early 2008 through late 2009, Mr. Wright served as the Chief Executive Officer of Nova Group Services. Prior to joining Nova Group Services, Mr. Wright served as the Chief Executive Officer of Bureau Veritas, U.S. (“BV”), where he was responsible for developing BV’s U.S. operations through strategic acquisitions and follow-on growth. Before Mr. Wright joined BV, it had a minimal presence in the United States; however, by the time Mr. Wright left BV in 2007, its U.S. operations employed 3,200 people in 67 offices and generated $280 million in revenue. Prior to BV, Mr. Wright founded U.S. Laboratories in 1993 and oversaw its growth to 1,000 employees and $80 million in revenue. Mr. Wright led U.S. Laboratories to a successful initial public offering in 1999 (NASDAQ: USLB), and, in 2001, U.S. Laboratories was named as the small cap growth stock of the year. Mr. Wright earned a Bachelor of Science degree in Engineering from Pacific Western University and is a board certified engineer in California.

Our Board believes that Mr. Wright’s experience founding, managing and building engineering and consulting firms into national engineering platforms, including a publicly traded engineering and consulting firm, provides us with highly valuable industry specific business, leadership and management experience.

Alexander A. Hockman. Mr. Hockman has served as a member of our Board of Directors since January 28, 2015 and as our Chief Operating Officer and President since January 1, 2015. Prior to becoming President and Chief Operating Officer, Mr. Hockman served as our Executive Vice President beginning September 2011 and President of NV5 - Southeast beginning February 2010.

Qualifications: Mr. Hockman has over 30 years of diverse experience in the fields of construction inspections, materials testing, geotechnical, environmental, waterfront, construction and building envelope consulting. From March 2003 until March 2010, Mr. Hockman served as the Chief Operating Officer of the Construction Materials Testing Division of BV. Further, from 1985 until its acquisition by BV in 2003, Mr. Hockman served as the President of Intercounty Laboratories. Mr. Hockman earned a Bachelor of Science degree in Civil Engineering from Florida International University and is a licensed engineer in Florida.

Our Board believes that Mr. Hockman’s experience in construction inspections, materials testing and industry specific consulting, provides us with highly valuable industry specific business and management experience.

MaryJo O’Brien. Ms. O’Brien has served as a member of our Board of Directors since June 9, 2018 and has served as our Executive Vice President, Chief Administrative Officer and Secretary since September 2011. Prior to her present role, Ms. O’Brien served as Executive Vice President of Human Resources and Administration of NV5 Global, Inc. from January 2010 to September 2011.

Qualifications: Ms. O’Brien has more than 30 years of experience in human resources, administration and the engineering and consulting industry. From March 2008 through November 2009, Ms. O’Brien served as the Director of Human Resources for Nova Group Services, Inc. From 2002 to 2008, Ms. O’Brien held various management positions with BV. Further, Ms. O’Brien served in similar human resources and administrative capacities for Testing Engineers - San Diego and U.S. Laboratories from 1987 to 2002. Ms. O’Brien earned a Bachelor’s degree in Communications and Business Economics from the University of California at San Diego.

Our Board believes that Ms. O’Brien has extensive administrative experience with public and financial accounting matters for corporate organizations and provides significant insight and expertise to our Board on human resources and relations, executive compensation and public company reporting.

Non-Employee Directors

William D. Pruitt. Mr. Pruitt has served as a member of our Board since March 26, 2013.

Qualifications: Mr. Pruitt has served as General Manager of Pruitt Enterprises, LP and President of Pruitt Ventures, Inc. since 2000. Mr. Pruitt has more than 20 years of experience as an independent board member for numerous companies and has held various roles as either member or chairman for these companies’ audit committees. These companies include MAKO Surgical Corp., a developer of robots for knee and hip surgery; Swisher Hygiene, Inc., a hygiene services company; the PBSJ Corporation, an international professional services firm; KOS Pharmaceuticals, Inc., a fully integrated specialty pharmaceuticals company and Adjoined Consulting, Inc., a full-service management consulting firm. From 1980 to 1999, Mr. Pruitt served as the managing partner for the Florida, Caribbean and Venezuela operations of the independent auditing firm of Arthur Andersen LLP. Mr. Pruitt earned a Bachelor of Business Administration degree from the University of Miami and is a Certified Public Accountant, in good standing.

Our Board believes that Mr. Pruitt’s extensive experience with public and financial accounting matters for corporate organizations, as well as experience as a consultant to and Director of other public companies, provides significant insight and expertise to our Board.

François Tardan has served as a member of our Board since January 28, 2015.

Qualifications: Mr. Tardan has served as Chief Executive Officer of Leitmotiv Private Equity since 2012. From 1998 to 2011, Mr. Tardan served as Executive Vice President and Chief Financial Officer of BV. During Mr. Tardan’s tenure at BV, revenues grew from €650 million to €3.4 billion and EBITDA margins increased from 8% to 16.5%. Under his leadership, the company also completed more than 100 acquisitions in Asia, North America, Latin America, and Europe and completed a successful IPO in 2007 with a placement exceeding €1 billion. BV shares increased in price from €37.7 to €56 during the time Mr. Tardan was with the company despite the impact of the 2008 financial crisis. Before 1998, Mr. Tardan was President and CEO of Fondasol, a notable European geotechnical firm. François Tardan graduated from Ecole Nationale d’Administration (ENA) in Paris and received his MBA from Ecole des Hautes Etudes Commerciales (HEC).

Our Board believes that Mr. Tardan’s extensive financial accounting experience with corporate organizations combined with his international leadership experience, provides significant accounting expertise and exceptional global perspective that will aid our Board in making sound decisions regarding our expansion into international markets.

Laurie Conner. Ms. Conner has served as a member of our Board since June 8, 2019.

Qualifications: Ms. Conner has over 35 years of experience in technology companies focusing on strategy, marketing, sales and business development. Ms. ConnorConner has been President and CEO of the Detection Group, a Watts brand, a cloud-based IoT technology solution for commercial buildings to reduce water losses, since July 2013. Previously, Ms. ConnorConner served as President of Gazebo Capital Management LLC, a financial technology and investment firm and as Global Vice President of Sales and Marketing for a division of New Focus, a leader in optical networking and photonics. Ms. Conner holds a Bachelor degree in Civil Engineering from Duke University, a Masters degree in Civil & Environmental Engineering from Stanford University and a Masters of Business Administration from the Harvard Business School.

Our Board believes that Ms. Conner’s years of experience with technology companies combined with her senior managerial experience in sales and marketing provides significant expertise and perspective that will aid our Board in making sound decisions regarding our expansion into new markets.

Michael RenshawDr. Denise Dickins. Dr. Dickins has served as a member of our Board since August 25, 2021.

Qualifications: Dr. Dickins is Professor Emeritus at East Carolina University where she was employed from 2006 to 2022 and taught courses in auditing and corporate governance. From 2002 to 2006, while earning her Ph.D., she was an instructor of various accounting courses at Florida Atlantic University. Prior to that, she served in varying capacities with Arthur Andersen LLP from 1983 to 2002, including Partner in Charge of the South Florida Audit Division. Dr. Dickins is a certified public accountant and certified internal auditor and has served on the board of several publicly traded companies. She currently serves on the board of Watsco, Inc. (chair of the audit committee and chair of the compensation committee). Dr. Dickins brings auditing and accounting, social, and corporate governance skills to the Board.

Our Board believes that Dr. Dickins extensive experience with public and financial accounting and auditing matters for corporate organizations, her research on corporate governance, auditing, and diversity-related matters, as well as her experience as the Partner in Charge of the South Florida Audit Division at Arthur Andersen provide significant insight and expertise to our Board.

Brian C. Freckmann. Mr. RenshawFreckmann has been nominated as a candidate for election as a member of the Board of Directors at the 20212023 Annual Meeting.

Qualifications: Mr. RenshawFreckmann is the founder of Lyon Street Capital and has 29served as General Partner since 2008. Prior to founding Lyon Street Capital, he served as a Portfolio Manager at Crown Capital from 2003 to 2008. Mr. Freckmann has over 20 years of senior management experience and possesses a strong understanding of international markets, strategic management, M&A, and profitable growth at the Board and Senior Executive level. Mr. RenshawFreckmann earned a Bachelor of Arts degree from the University of Pennsylvania. Mr. Freckmann has served as Executive Vice Presidentan Advisory Board member at NV5 since 2020. Mr. Freckmann brings investing, strategic research, and Chief Growth Officer of AECOM since March 2017. During Mr. Renshaw's tenure at AECOM, net service revenues of the U.S. Design and Consulting business grew 8% to $3.2 billion and EBITDA grew 60% to $446 million. Mr. Renshaw has also served as a Non-Executive Director of Opteon since 2015, one of Australia's largest property valuation firms with operations in Australia, New Zealand and the United States. Before relocatingM&A skills to the United States, Mr. Renshaw was Chair of Opteon and oversaw the integration of 19 franchisees into a single corporate entity and the United States expansion strategy. Prior to joining AECOM, Michael had his own executive consulting firm advising private equity on investments in engineering and environmental consulting. From 2003 to 2015, Mr. Renshaw served as the CEO and Managing Director of Cardno, an engineering, environmental and management services company. During Mr. Renshaw's tenure at Cardno, he negotiated and led the integration of 17 strategic acquisitions with a combined enterprise value of $480 million. Mr. Renshaw has served as Chair and Director on a number of operating companies in Australia, New Zealand, United States, Canada, United Kingdom, Germany, Ecuador, Columbia, Indonesia, Singapore and the Philippines. Mr. Renshaw holds a Bachelor degree in Business from Central Queensland University and completed the Advanced Management Program at Harvard Business School.Board.

Our Board believes that Mr. Renshaw’s years ofFreckmann's extensive experience with engineering companies combined withstrategic research on M&A and his experience achieving growth initiatives providesas General Partner at Lyon Street Capital provide significant insight and expertise and perspective that will aidto our Board in making sound decisions regarding our continued expansion.Board.

EXECUTIVE OFFICERS

The following sets forth information regarding our non-director executive officers as of the date of this 20212023 Proxy Statement. For information regarding Dickerson Wright, our Chief Executive Officer and Chairman, Alexander A. Hockman, our Chief Operating Officer, President and Director, and MaryJo O’Brien, our Executive Vice President, Chief Administrative Officer and Secretary and Director, see “Proposal No. 1 - Election of Directors” above.

| | | | | | | | |

| Name | Age | Position |

| Donald C. Alford | 7779 | Executive Vice President |

| Richard Tong | 5254 | Executive Vice President and General Counsel |

| Edward H. Codispoti | 5052 | Chief Financial Officer |

Donald C. Alford. Mr. Alford served as a member of our Board from March 26, 2013 to June 9, 2018 when he retired from the Board at the 2019 Annual Meeting. Mr. Alford has served as our Executive Vice President since September 2011 and as the Executive Vice President of NV5 Global, Inc. since February 2010 and is responsible for M&A and other growth initiatives. From February 2007 until February 2010, Mr. Alford held a similar position with Nova Group Services, Inc. From November 2002 to November 2006, Mr. Alford acted as the exclusive M&A agent in the U.S. for BV. Further, from 1998 to 2002, Mr. Alford served as the Executive Vice President and Secretary for U.S. Laboratories. Mr. Alford earned a Bachelor of Arts degree in History from Princeton University and a Master of Business Administration degree from the University of Virginia. Mr. Alford also served as an officer in the U.S. Marine Corps from 1965 until 1968.

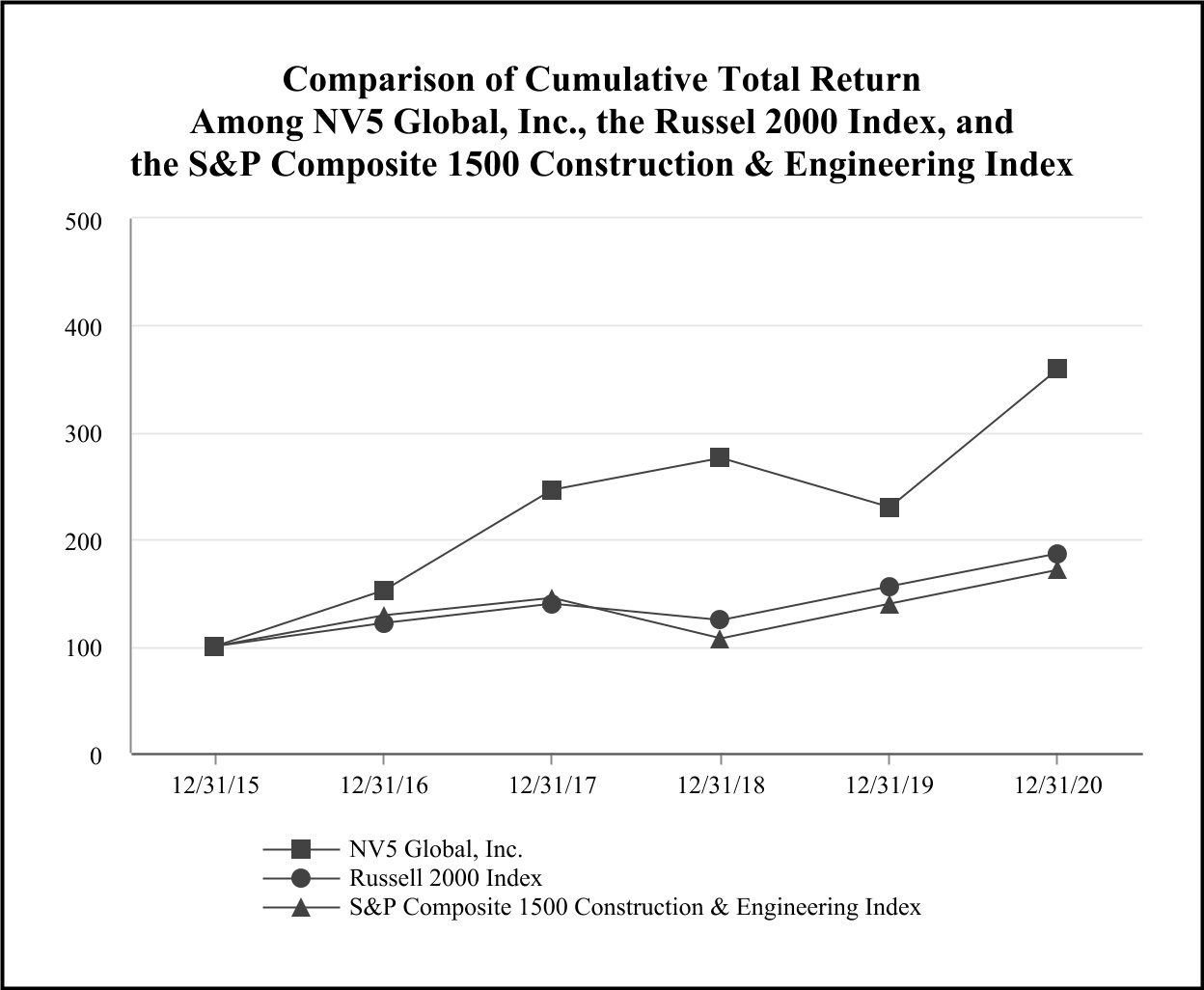

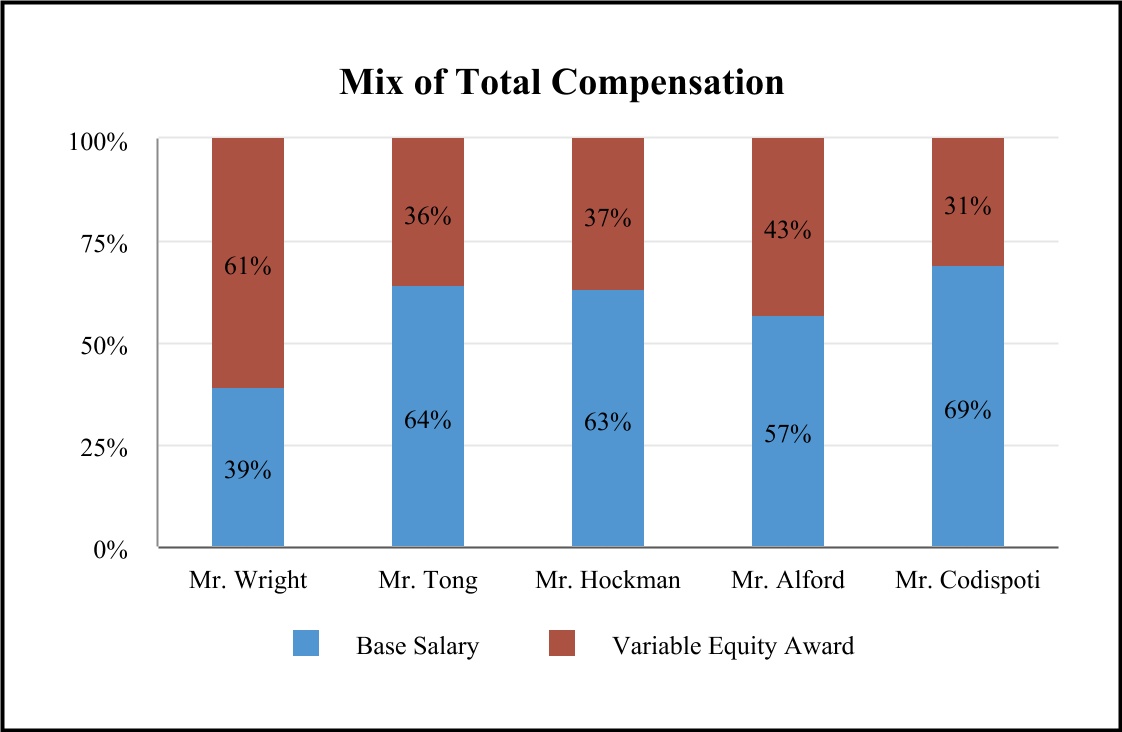

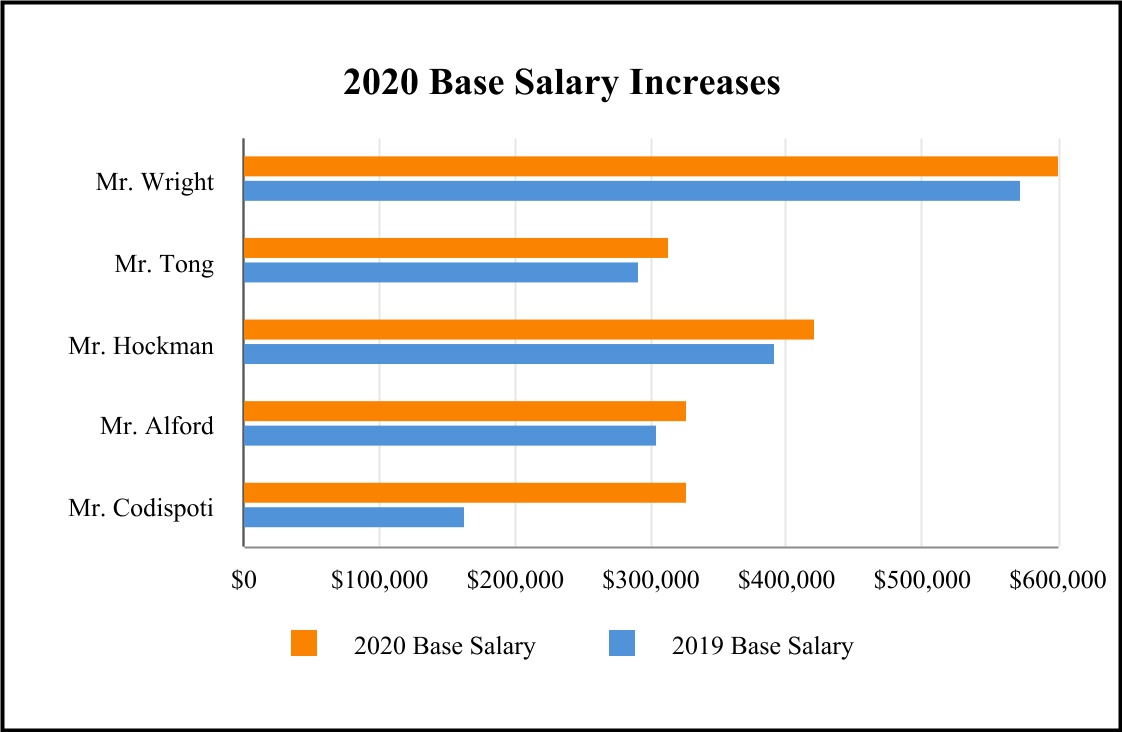

Richard Tong. Mr. Tong has served as our Executive Vice President and General Counsel since April 2010. Mr. Tong has approximately 20 years of experience working in the engineering, environmental, consulting, testing and inspection industry. In his capacity as our Executive Vice President and General Counsel, Mr. Tong devotes a considerable amount of time to acquisitions, strategic planning, corporate compliance and legal matters. From November 2008 through November 2009, Mr. Tong served as the Executive Vice President and General Counsel of Nova Group Services, Inc., an engineering and consulting services company. Mr. Tong also served as the Executive Vice President and General Counsel for BV from January 2003 until